Be Rewarded For Doing Business As Usual

Capture Tax Credits &

Increase Profitability.

The US government offers over 3,000 state & federal incentive programs to reward business owners for basic business functions like retaining employees, job creation, innovating internal processes and more.

OnCentive makes it easy for businesses to access and secure lucrative incentives and tax credits. As your trusted profitability partner, we handle all the paperwork and legwork, so you can focus on growing your business. Best of all, our services come with no risk to you – you'll receive all the benefits, with none of the hassle.

$3 Billion

CAPTURED CREDITS

$0

UPFRONT COST

150+ Years

CREDIT EXPERIENCE

100%

AUDIT SUPPORT

CREDIT SPOTLIGHT:

Covid-19 Employee Retention Credit

The Employee Retention Tax Credit (ERC) is a refundable tax credit that encourages businesses to keep employees on their payroll.

Introduced by the CARES Act, it’s worth up to $5,000 per employee in 2020 and up to $7,000 per employee per quarter in 2021 (for the first three quarters), for a max credit of $26,000 per employee.

$26,000

maximum credit amount

$1Billion+

refundable ERC credits secured for clients

Fast Funding

Through our trusted funding partner, you can receive your ERC in weeks versus waiting months on the IRS.

Pay When You Get Paid

OnCentive works on success-based fees which means you pay only once you receive your credits.

Full Service Processing

With our platform, you’ll save time when you most need it, while serving your customers.

NO MORE WAITING ON THE IRS

Accelerate Refunds with OnCentive's Funding:

Receive your ERC in WEEKS

At OnCentive, we're dedicated to providing a fast and reliable solution to the long wait for your Covid-19 Employee Retention Tax Credits. Thanks to our network of trusted funding partners, we can offer you funding within just a few weeks - bypassing the typical eight to nine-month wait from the IRS.

Meet Our Tax Credit & Financial Experts

Shannon Scott

CEO & Cofounder

Chris Smith, CPA

President

Frank Brown, J.D., LL.M.

Chief Incentive Officer & Cofounder

Garrett Gregory, Esq., LL.M.

Special Counsel for Tax Compliance

Joshua Hole, CPA, MT

President of Special Incentives

Roger Boatner, CPA

Partner

Schedule a call with an OnCentive Expert

Don’t Disqualify Yourself. Our Experts Determine Your Eligibility For Free.

Despite its meaningful impact, only 1% of qualified employers have filed

for ERTC in 2020 and only 3% in 2021.

In The News

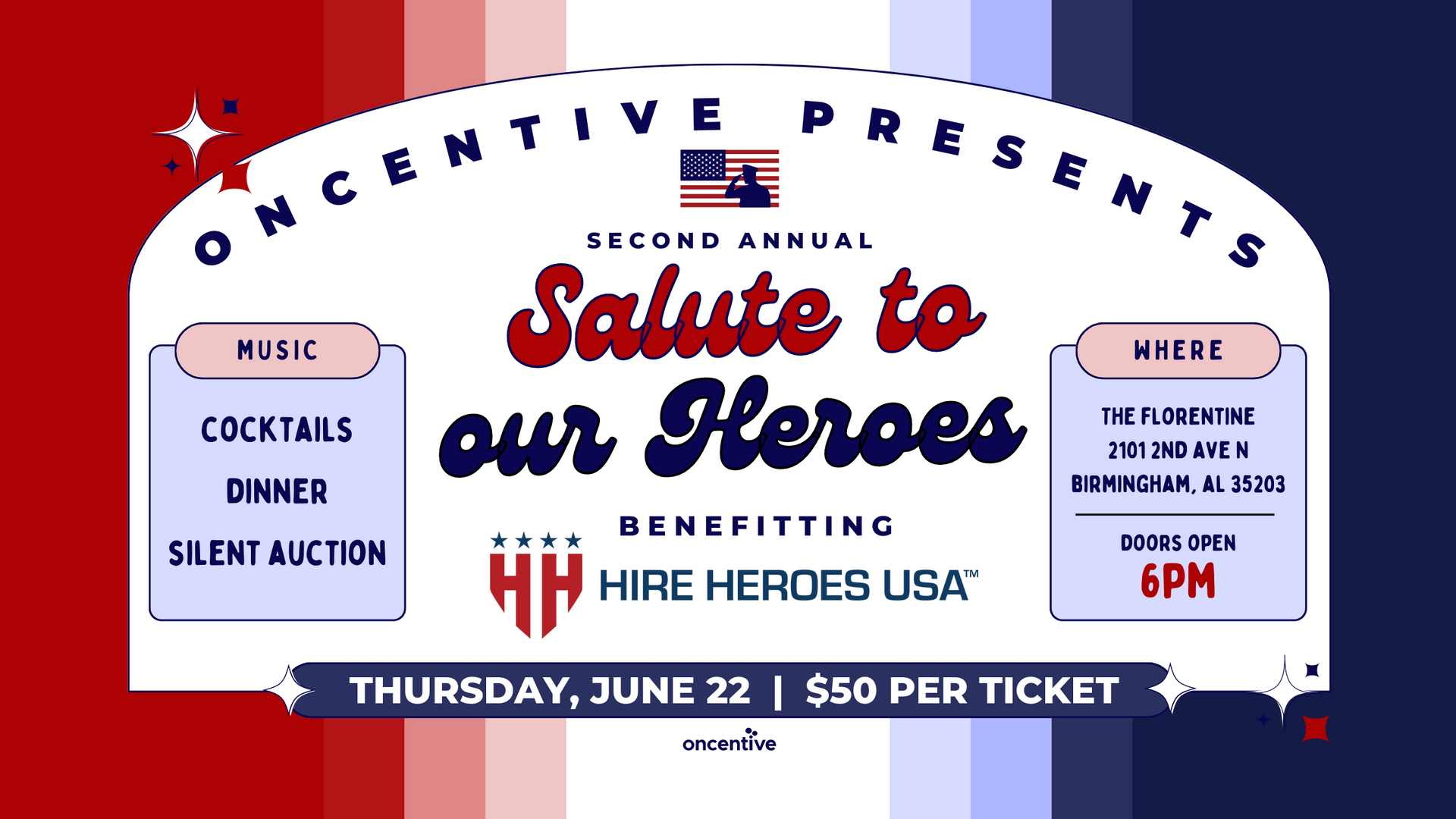

OnCentive Amplifies Support for Veterans with Second-Annual 'Salute to Our Heroes' Fundraising Event

Blog

<script type=" text=""/>

<script type=" text=""/>