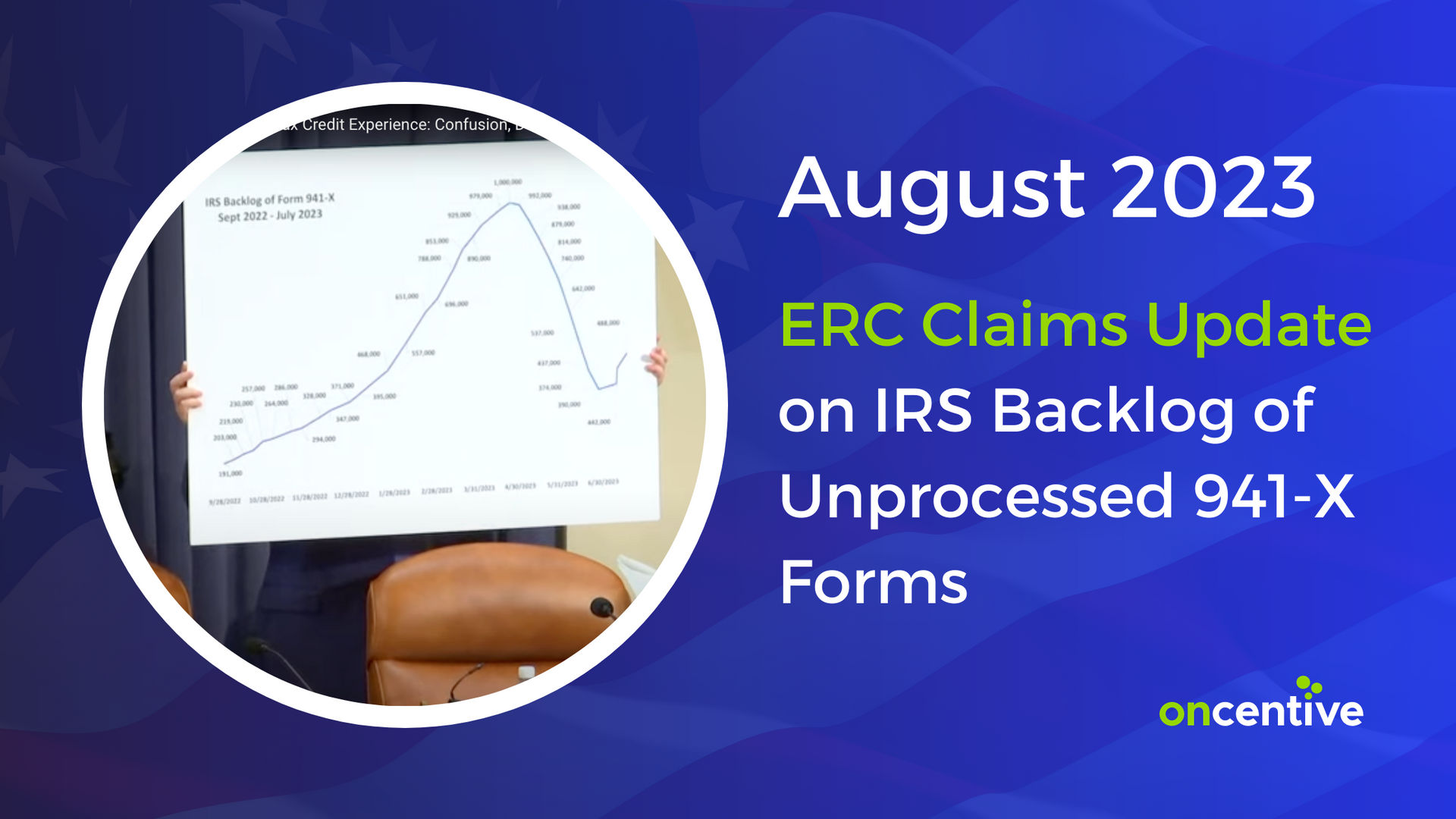

What You Need to Know About the Disaster Employee Retention Credit

What is a Qualified Disaster?

A qualified disaster is when an area has been declared 'a disaster area' by a federal government agency.

What is the Employee Retention Credit?

The employee retention credits are for employers with worksite location(s) inside a qualified disaster zone. These credits are available if your business became impacted due to the disaster, but you continued to pay your employees during the qualified period following the disaster.

The amount of the credit is determined by the amount of qualified wages paid to eligible employees. The credit is forty percent of qualifying wages up to $6,000 per eligible employee. The maximum credit is $2,400 per qualifying employee.

The employee retention credit will be applied against your federal business income taxes.

What are Qualified Wages?

Qualified wages are the wages paid to an employee working during the time the disaster occurred in which your business was impacted by the disaster. The employees’ worksite location at the time of the disaster must be in an eligible disaster area and the business’s normal operations impacted by the disaster.

The incident period begins at any time on or after your business became inoperable and ends on the earliest date your business returned to significant operations. The maximum allowed qualification period is 150 days after the disaster incident end date.

Qualified wages include the wages you paid without regard to the employee performing services at a different location from their principal place of employment or performing services at their principal place of employment before significant operations begin again. Regardless of whether your business was reimbursed through your insurance, you are still considered qualified for the credit.

Qualified wages under the disaster provision do not include wages that qualify under the employee retention credits found under Section 2301 of the CARES Act.

Impact of Other Relief Provisions and Credits

If you are an eligible employer, your ability to claim employee retention credits will be impacted by other relief provisions and credit:

- Employees will not be counted if you are allowed a Work Opportunity Tax Credit under Section 51 of the IRS code for the employee

- Wages considered for this credit cannot be counted for the credit for paid Family and Medical Leave under Section 455 of the IRS code

- If you received wages where a tax credit was applied under the Families First Coronavirus Response Act Wages on paid family and sick leave, these are also not eligible for the employee retention credit.

- Wages used for the Research & Development Credit (Sec. 41)

- Wages used for the Indian Employer Credit (Sec. 45A)

- Wages used for Empowerment Zone Employer Credit (Sec. 1396)

- Wages used for the employer wage credit for employers of active duty military (Sec. 45P)

- Wages used for calculation of the credit for businesses offering FMLA policy (Sec. 45P)

If you have questions about how you qualify for employee retention credits, talk to the tax experts at ETaxBreaks.

Who to Talk to About Tax Credits for Your Business

OnCentive is committed to helping your business get back what you are owed. With over twenty years of experience in the tax incentives industry, we can maximize your credit, ensure accuracy and create additional cash flow for your company.

Have Questions or Need More Information?

<script type=" text=""/>

<script type=" text=""/>