IRS Releases 2023 Draft Form 941-X Used For Claiming COVID-19 Employee Retention Credit Amidst Growing Backlog

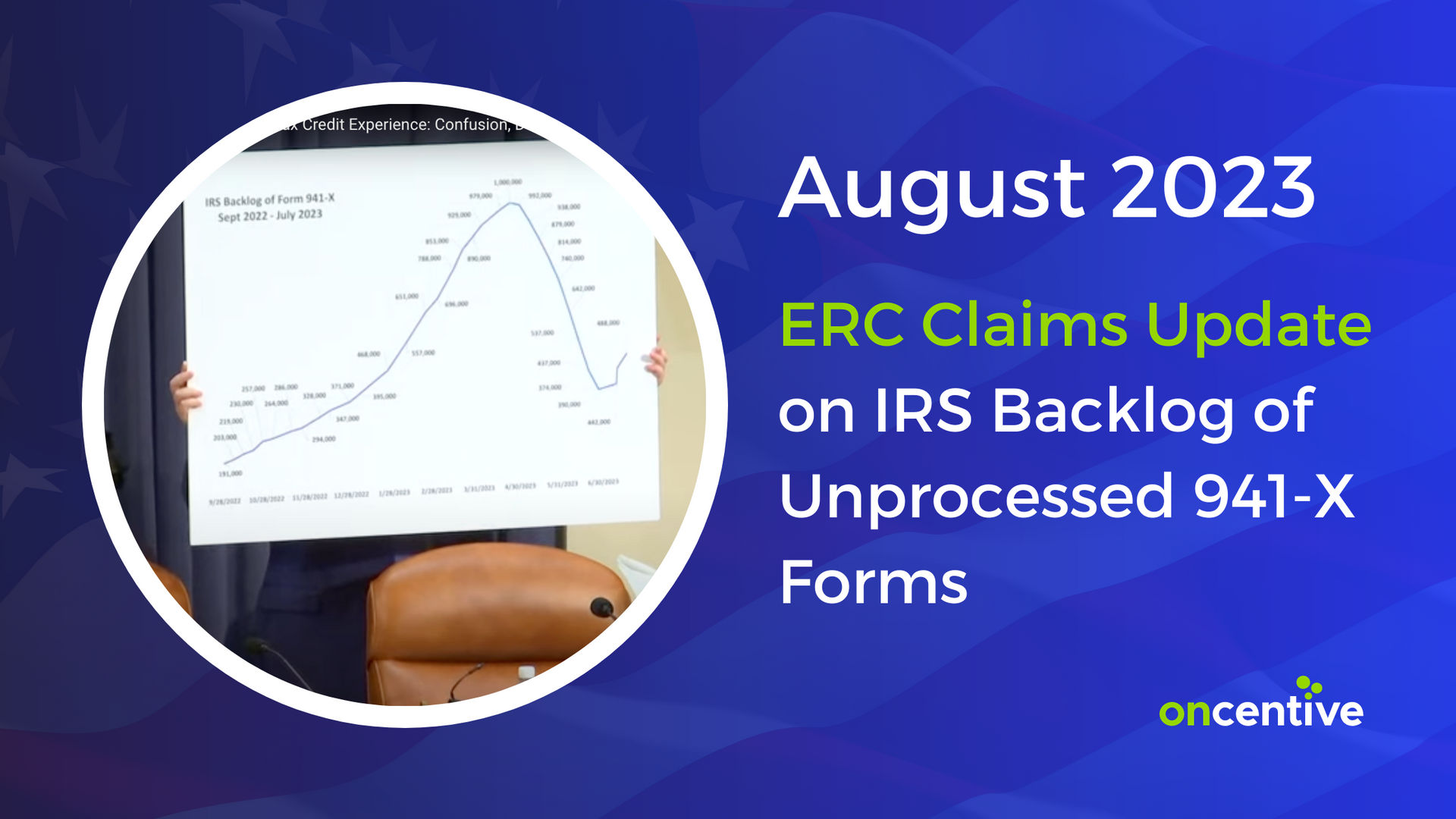

Just days before the release of the April 2023 draft version of Form 941-X (Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund), the Internal Revenue Service (IRS) announced a staggering backlog of nearly one million unprocessed Forms 941-X. This form is crucial for employers who need to adjust their previously filed Form 941 to account for employment taxes and tax credits, such as the COVID-19 Employee Retention Credit (ERC).

In an effort to tackle this backlog, the IRS has been diligently working to process Forms 941, since the corresponding 941-X forms cannot be completed until the 941 forms have been processed.

As of April 19, 2023, the IRS reported that only 148,000 Forms 941 remain unprocessed, signaling a potential shift in focus towards the 941-X backlog in the near future.

The

most recent version of Form 941-X was released in April 2022, with the April 2023 draft containing only minor modifications. To address potential concerns, the IRS has included a note on the cover page of the draft, stating that they will release a new draft if any unexpected issues arise that necessitate changes to the form.

As part of the

Inflation Reduction Act of 2022, the legislation

allocated nearly $80 billion over a 10-year period to the IRS with some of those funds dedicated to modernizing and digitizing their paper form processing system. At present, Forms 941-X can only be submitted in paper format, but IRS Commissioner Daniel Werfel has committed to implementing

increased digital scanning capabilities during the upcoming filing season in order to alleviate the paper form backlog.

In preparation for potential COVID-19 Employee Retention Credits related to unprocessed Form 941-X returns, the IRS has trained staff at its Cincinnati and Ogden facilities to handle these specific cases. Employers still have the opportunity to file for the COVID-19 ERC, and those seeking assistance with claiming the ERC are encouraged to

reach out to the experts at OnCentive.

If you are one of the nearly million employers waiting for the IRS to process your Form 941-X, there is some relief through OnCentive's funding program. This program bypasses the typical eight to nine-month wait from the IRS and provides immediate cash infusion to clients within weeks.

For more information on OnCentive’s funding program, please visit https://www.oncentive.com/covid-19-erc-funding.

Have Questions or Need More Information?

<script type=" text=""/>

<script type=" text=""/>