Follow us

10 Street Name, City Name Country, Zip Code555-555-5555myemail@mailservice.com

Estimate your R&D tax credit.

Estimate your R&D tax credit_Landing Page

We will get back to you as soon as possible.

Please try again later.

or call 205-203-8097

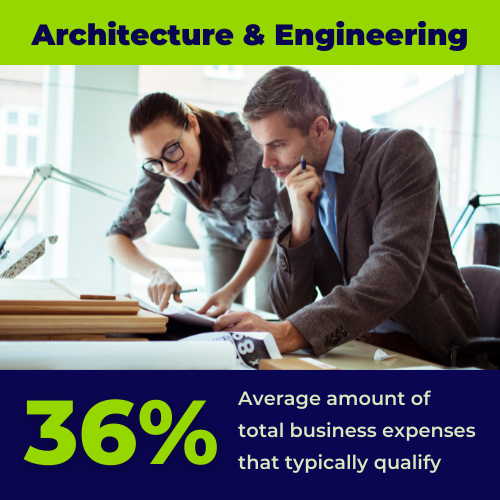

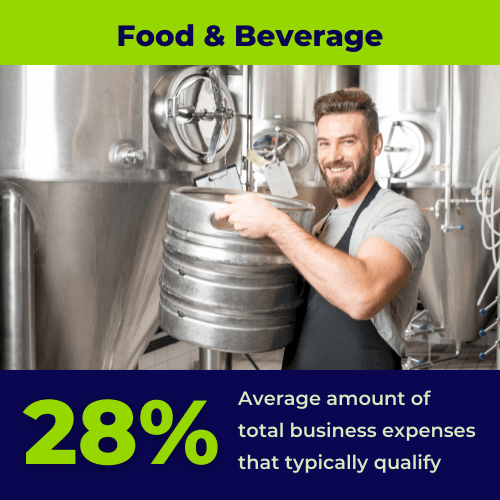

Industries that qualify for R&D include:

- Manufacturing

- Software

- Architecture

- Telecommunications

- Construction

Use Against Income Tax

You can match the credit against income tax dollar for dollar.

No Limit on How Much You Can Claim

Help your growth business grow with no limits on how much you claim.

Carries Forward for Future Growth

The tax credit carries forward for 20 years and you receive money every year you are eligible.

The Research and Development (R&D) Tax Credit is a $18B government incentive offered to companies who create or improve products or processes in the course of their business.

The Federal R&D tax credit is available to US businesses that develop or improve new products, processes, software, formulas, or business components. Additionally, over 30 states offer R&D credits to offset state tax liability.

R&D Tax Credits increase your profitability by reducing, current and future years’ federal tax liability and creating a ready source of cash for furthering innovation and growing your business. These credits provide a dollar-for-dollar offset against taxes owed or paid, which differs from a deduction.

Despite originally only applying to a few highly technical companies, the R&D Tax Credit was made permanent by the PATH ACT of 2015 and the definition of the credit expanded, allowing a wider range of businesses and industries to qualify for this significant valuable federal tax credit.

$250,000

POTENTIAL CASH SAVINGS PER YEAR AGAINST FEDERAL FICA PAYROLL TAXES

$14.8B

IN R&D CREDITS

CLAIMED ANNUALLY

42%

OF R&D CREDITS CLAIMED ARE BUSINESSES WITH LESS THAN $5 MILLION IN REVENUE

Free your HR Department

Eliminate the burden of verifications

Free your HR Department

Eliminate the burden of verifications

Take the burden off your HR team and eliminate the need for in-house verifications. Partnering with Clear Verify ensures a streamlined, compliant, and organized verification process, with all your employees' verifications conveniently consolidated in one place. Say goodbye to the risks associated with internal verification and embrace the efficiency and peace of mind offered by Clear Verify.

Take the burden off your HR team and eliminate the need for in-house verifications. Partnering with Clear Verify ensures a streamlined, compliant, and organized verification process, with all your employees' verifications conveniently consolidated in one place. Say goodbye to the risks associated with internal verification and embrace the efficiency and peace of mind offered by Clear Verify.

Mitigate Risk & Liability

When it comes to in-house verifications, there are inherent risks and liabilities. Clear Verify eliminates these concerns by prioritizing security and authenticity. Clear Verify ensures each verification is conducted by a legitimate and credential verifier. Rest assured that your verifications are in safe hands, reducing risk and ensuring compliance with Clear Verify's robust verification process.

Mitigate Risk & Liability

When it comes to in-house verifications, there are inherent risks and liabilities. Clear Verify eliminates these concerns by prioritizing security and authenticity. Clear Verify ensures each verification is conducted by a legitimate and credential verifier. Rest assured that your verifications are in safe hands, reducing risk and ensuring compliance with Clear Verify's robust verification process.

Verify ME

We are thrilled to introduce Verify Me, a groundbreaking feature that puts the power of verification directly in the hands of your employees. With Verify Me, your employees can initiate and send verification requests directly to verifiers, conveniently review your employment data, dispute any outdated information, and effortlessly download standard reports.

Verify ME

We are thrilled to introduce Verify Me, a groundbreaking feature that puts the power of verification directly in the hands of your employees. With Verify Me, your employees can initiate and send verification requests directly to verifiers, conveniently review your employment data, dispute any outdated information, and effortlessly download standard reports.

VERIFICATION INBOX

With Clear Verify, employers, employees, and verifiers all have access to a dedicated verification inbox, streamlining the verification process. This centralized location serves as a hub for all verifications, allowing users to conveniently monitor the progress of their verifications, review activity logs, and easily download reports, allowing a seamless experience for all users.

VERIFICATION INBOX

With Clear Verify, employers, employees, and verifiers all have access to a dedicated verification inbox, streamlining the verification process. This centralized location serves as a hub for all verifications, allowing users to conveniently monitor the progress of their verifications, review activity logs, and easily download reports, allowing a seamless experience for all users.

FILE UPLOADS &

AUDIT TRAILS

Clear Verify takes the hassle out of payroll mapping with its flexible system. During implementation, you only need to map your data

once, saving valuable time and effort. Additionally, our audit trail reports offer a comprehensive record of any changes made with each upload, ensuring transparency and accountability.

FILE UPLOADS & AUDIT TRAILS

Clear Verify takes the hassle out of payroll mapping with its flexible system. During implementation, you only need to map your data

once, saving valuable time and effort. Additionally, our audit trail reports offer a comprehensive record of any changes made with each upload, ensuring transparency and accountability.

TOTAL COMPLIANCE

Clear Verify understands the importance of compliance with both current and future state regulations. That's why we collaborate closely with industry leaders to ensure that our platform meets all necessary compliance standards. Through continuous updates and enhancements, Clear Verify remains up-to-date with emerging requirements, providing you with a robust and compliant verification solution. Rest assured that Clear Verify is your trusted partner in maintaining regulatory adherence in an ever-evolving industry.

TOTAL COMPLIANCE

Clear Verify understands the importance of compliance with both current and future state regulations. That's why we collaborate closely with industry leaders to ensure that our platform meets all necessary compliance standards. Through continuous updates and enhancements, Clear Verify remains up-to-date with emerging requirements, providing you with a robust and compliant verification solution. Rest assured that Clear Verify is your trusted partner in maintaining regulatory adherence in an ever-evolving industry.

MOBILE FUNCTIONALITY

With its mobile-friendly functionality, Clear Verify empowers employees to conveniently send verifications to verifiers anytime, anywhere. Our platform ensures 24/7 accessibility, enabling a seamless verification process even while on the move. Say goodbye to time constraints and embrace the freedom of mobile verifications with Clear Verify.

MOBILE FUNCTIONALITY

With its mobile-friendly functionality, Clear Verify empowers employees to conveniently send verifications to verifiers anytime, anywhere. Our platform ensures 24/7 accessibility, enabling a seamless verification process even while on the move. Say goodbye to time constraints and embrace the freedom of mobile verifications with Clear Verify.

How EMPLOYEEs' CAN COMPLETE A VERIFICATION

Clear Verify offers two seamless methods for employees to complete verifications. Employers will need to upload their employees' data into the platform, ensuring that the necessary information is readily available for verification request.

How EMPLOYEEs' CAN COMPLETE A VERIFICATION

Clear Verify offers two seamless methods for employees to complete verifications. Employers will need to upload their employees' data into the platform, ensuring that the necessary information is readily available for verification request.

When an employee needs a verification, they have two options:

Option 1: The verifier can submit a request to pull the employees' data from Clear Verify's platform for the relevant verification. Depending on the employer's configured settings or compliance requirements specific to their state, employees will be given the option to grant or deny permission for their data to be released to the verifier.

Option 2: Alternatively, employees can take advantage of our "Verify Me" feature by sending verifications directly to verifiers themselves. This feature enables them to initiate verification requests directly with verifiers and additionally download lighter employment forms.

Liberate your HR Department from the burdensome task of verifications, and empower your employees to access their data whenever they require it.

When an employee needs a verification, they have two options:

Option 1: The verifier can submit a request to pull the employees' data from Clear Verify's platform for the relevant verification. Depending on the employer's configured settings or compliance requirements specific to their state, employees will be given the option to grant or deny permission for their data to be released to the verifier.

Option 2: Alternatively, employees can take advantage of our "Verify Me" feature by sending verifications directly to verifiers themselves. This feature enables them to initiate verification requests directly with verifiers and additionally download lighter employment forms.

Liberate your HR Department from the burdensome task of verifications, and empower your employees to access their data whenever they require it.

Frequently asked questions:

Frequently asked questions:

The innovations your company is working on may be eligible for lucrative tax credits.

If your company is creating new products, or improving existing products or processes, there is a strong likelihood you are eligible for the R&D Tax Credit.

In addition to the federal credit, many states offer tax incentives for companies pursuing innovation within their industry. Pre-revenue companies and start-ups with less than five years of revenue can use the federal R&D tax credits to offset future payroll taxes.

OnCentive's team of credit experts, CPAs, and tax lawyers can help your business explore your Research & Development eligibility. At Oncentive, we work on a flexible value-based fee structure where many times no fees are due until our R&D analysis is completed. We offer complete audit support and a money-back guarantee.

FAQ: Research & Development Tax Credit

-

What activities qualify for R&D tax credit?

Qualifying R&D expenses and/or activities are those which pass this four-part test:

Technical uncertainty.

The activity is performed to eliminate technical uncertainty about the development or improvement of a product or process, which includes computer software, techniques, formulas, and inventions.

Process of experimentation.

The activities include some process of experimentation undertaken to eliminate or resolve a technical uncertainty. This process involves an evaluation of alternative solutions or approaches and is performed through modeling, simulation, systematic trial and error, or other methods.

Technological in nature.

The process of experimentation relies on the hard sciences, such as engineering, physics, chemistry, biology, or computer science.

Qualified purpose.

The purpose of the activity must be to create a new or improved product or process, including computer software, that results in increased performance, function, reliability, or quality.

-

How large will my R&D tax credit be?

Unlimited, if applying the R&D credit against income taxes. These credits can range between 5% and 15% of qualifying R&D costs. If taking the PATH Act R&D credit, a company can receive up to $250k against payroll taxes and take the remainder against income taxes.

-

Can I claim the R&D credit retroactively?

Yes, we can help you file an amended tax return to claim the R&D credit for previously filed income tax returns (past 3 years), but you cannot take the PATH Act R&D credit on an amended tax return.

-

Will claiming the R&D credit result in an audit?

The rate of audits among R&D clients is no larger than the rate of clients whose income tax returns are audited. Be proactive about audit readiness while maximizing your credit value by working with an R&D credit expert.

Not Sure If You Qualify?

Our Experts Determine Your Eligibility For Free.

We understand that understanding and applying for the R&D Tax Credit may feel daunting. The important thing to remember is that you won’t be alone. OnCentive tax credit experts will be there with you every step of the way, to walk you through the process and help you prepare all the necessary documentation.

A 15-minute call can qualify you for the largest tax credit for US businesses.

-

Industry Expertise

Learn more →OnCentive has the expertise and

knowledge to maximize your tax

credits while maintaining

compliance.

-

Simplified Processing

Learn more →Our risk-free model puts your hard

earned money back in your hands

so you can use it to grow your

business.

-

Thought Leadership

Learn more →Frequently consulting the House

Ways and Means & Senate Finance

Committees, OnCentive stays

abreast of the latest legislative news

impacting tax credits and

incentives.

What Clients Say About OnCentive:

Don't just take it from us.

Morgan Akins, The Arc of Tuscaloosa

"The OnCentive team helped our non-profit raise hourly wages to attract and retain employees through a very difficult labor market. The services we provide our clients are critical to the community. Thanks to OnCentive we are able to remain competitive as an employer. Their team is great to work with and without a doubt will help you maximize the amount your organization can recover.”

Tawny DeBolt, Neon HCM

"OnCentive has delivered millions of dollars in credits to our clients. We had them take a look at our business and they found over $100k in cash refunds for our company. Their staff treats every one of our clients like they are their own and our clients and ecstatic we made the introduction."

Cliff Morgan, CFO Concrete Guys

"OnCentive has exceeded our expectations. We were skeptical on whether or not these programs would work for us but they absolutely made us believers. I would highly recommend them to any business looking to increase its profitability.”

Led by Tax Attorneys,

CPAs & Credit Experts

Our leadership has over 150 years of combined tax experience. With $3 billion in incentives captured, you are in good hands with OnCentive.

Quality Guaranteed

In the unlikely event that your credit is ever contested, the OnCentive team will defend our work and will fully refund any credits that are disallowed.

Maximum Credit Yield

Our profitability is tied with yours. We work off success fees which means we are motivated to find the maximum credits your business can qualify for.

(855) 566-0829

info@oncentive.com

2127 1st Ave N

Birmingham, AL 35203

<script type=" text=""/>

<script type=" text=""/>